Condo Renting vs. Buying - A Case Study

By Condo Culture

Deciding whether to rent to buy is a major decision and there are a number of factors depending on your personal preferences, lifestyle, current financial situation and short and long term goals that will determine which option is right for you.

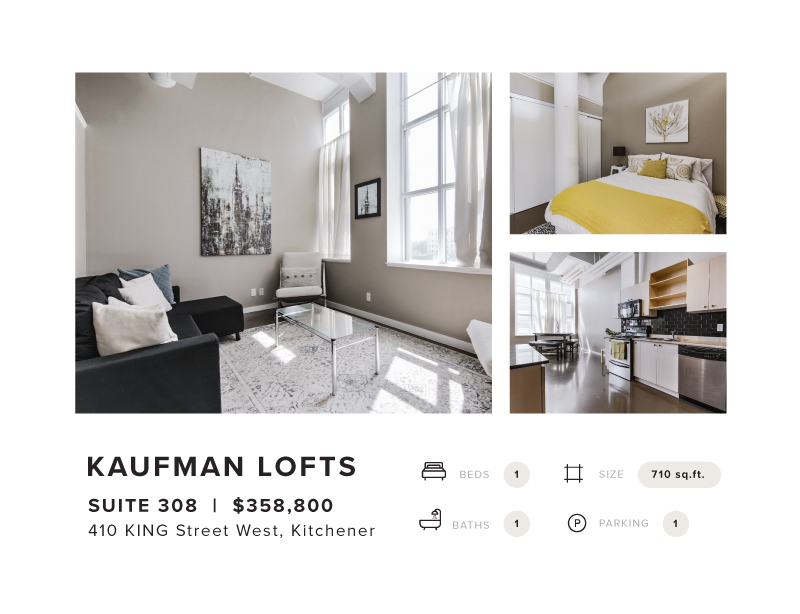

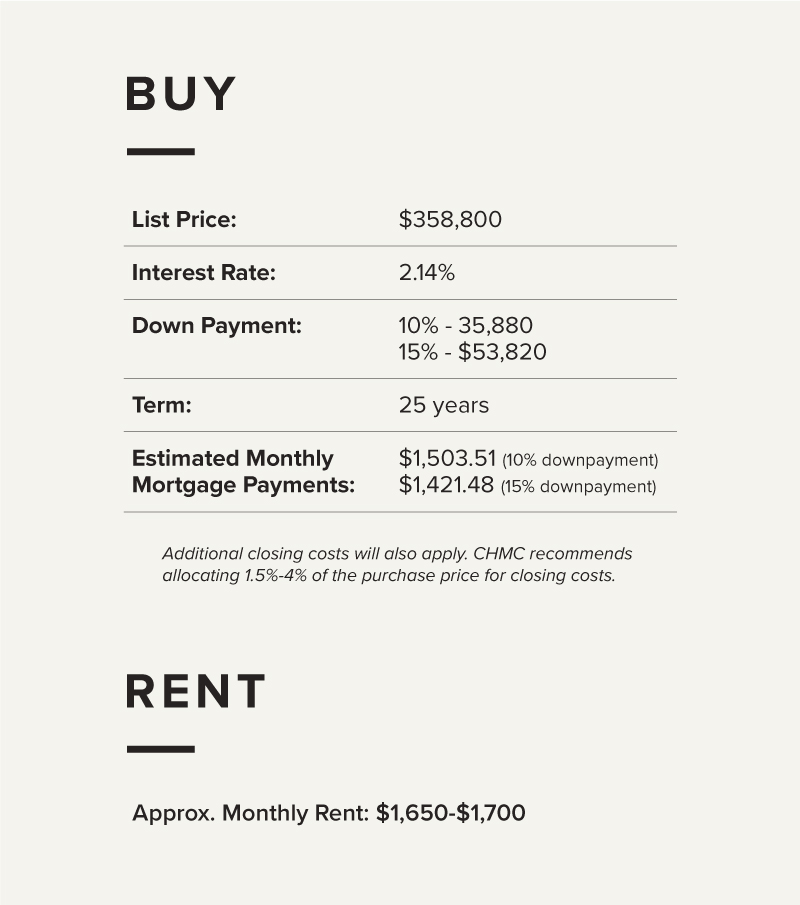

In this week's blog we take a look at the numbers, comparing the cost of Buying vs. Renting at our Featured Unit, a 1 Bed with Parking at the Kaufman Lofts in Kitchener.

In addition to a mortgage payment, owning a condo also comes with additional monthly expenses like property taxes and condo fees, which in the case of unit 308 at Kaufman lofts would be approximately $220.82 and $499.94 respectively. While the exact monthly mortgage payment will vary depending on your specific terms, (for e.g. a higher down payment would mean an even lower monthly mortgage payment) and all monthly expenses would need to be factored in, our case study demonstrates that there may not be a drastic difference between the cost of ownership and renting.

Benefits of Renting

Upfront Costs - The initial costs (e.g. rent deposits) associated with renting a condo are significantly lower than purchasing a condo that will most likely require a down payment and payment of any closing costs and immediate expenses.

Flexibility - Outside of your lease agreement, there is little obligation and commitment to a property when renting. Renters have the flexibility (with sufficient and allowable notice) to easily move to another property without much work and financial obligation.

Expenses - Tenants for the most part, are not responsible for the expenses associated with condo ownership (i.e. maintenance and repairs).

__Benefits of Ownership __

Investment - With condo values in the Kitchener-Waterloo region continuously increasing, owning a condo can act as an investment and provide huge returns if and when a buyer decides to sell.

Equity - With each mortgage payment and as the value of your condo increases, so does your equity (the difference between what you can sell your condo for and how much you still owe). This not only means you are one step closer to completely owning your condo (not the bank) but may also allow you to take out a home equity line of credit (HELOC). To learn more about HELOCs, their benefits and how they work, check out this video where our sales representative Raj breaks it all down.

Control & Stability - The ability to do pretty much whatever you want to your condo (e.g. renovations, remodeling), within building rules and guidelines. Owning a condo can also provide more stability as landlords have the ability in certain scenarios to provide notice which would require the tenant to move out. IE Selling the property and purchaser plans to move into the unit themselves.

If you're considering whether to rent or own, be sure to speak with your mortgage broker and real estate agent for a comprehensive look at all of the costs, considerations, pros and cons specific to you. At Condo Culture our team of experts would be more than to discuss your unique situation and provide expert advice.

You can also stop into our Waterloo Real Estate Store at any time. We are open and continue to practice all the necessary Co-vid protocols to keep our guests and staff safe.